LIFO method

What is the LIFO method?

The LIFO method (last in, first out) or LIFO (last input, first output) for its acronym in English, is an inventory valuation accounting procedure through which the The last items that enter the stock are the first to leave.

In general, the LIFO method is used by organizations that do not have large amounts of items in stock in their warehouses and whose products they do not have an expiration date, main difference with FIFO method.

Advantages and disadvantages of the LIFO method

Advantage

The advantages of the LIFO method are as follows:

- Pay less Income tax since merchandise is valued at higher (recent) costs, which lowers the basis on which the tax is calculated.

- The ending inventory cost is low, since the goods that remain in the warehouse are valued at older prices and, therefore, of lower value.

- Reflect with Greater precision inventory replacement costs based on recent acquisition costs.

Disadvantages

The disadvantages of the LIFO method are as follows:

- The application of the method is more complex, which requires a greater exhaustive work in the valuation of the different product lines.

- Being valued at the oldest prices, the inventory does not represent the real value of the items in stock.

- Several countries have prohibited its use as a valuation method by the distortion that it produces in the calculation of income tax. In a multinational company, the application of this criterion would create difficulties when consolidating balance sheets based on different methods.

LIFO method example

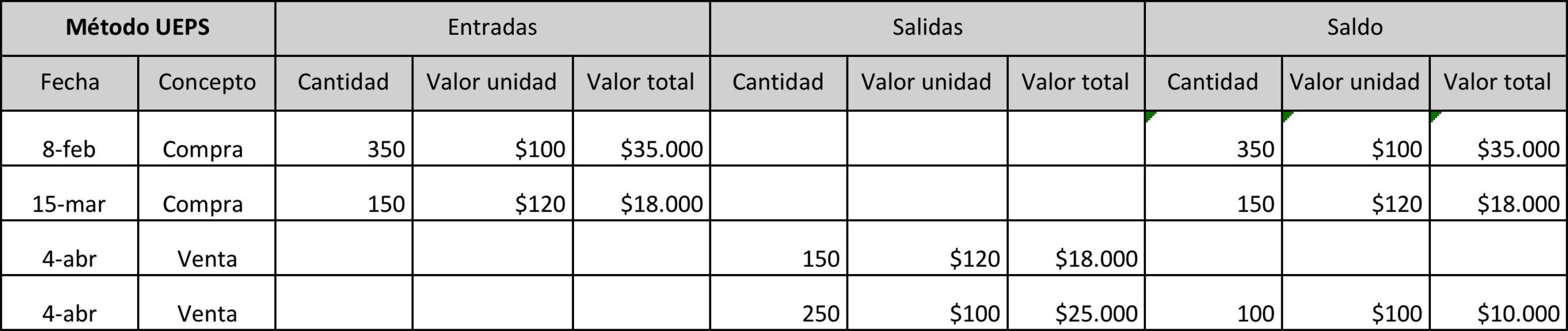

Let's look at the following example from a company that uses the LIFO method:

- On February 8 of this year, the company Mobiliario SA acquires 350 units at a unit cost of $ 100, which gives an inventory value of $ 35,000.

- In mid-March, he made a new purchase for 150 units at a cost of $ 120 each.

- On April 4, 400 units are sold. Applying the LIFO method, 150 units valued at $ 120 each come out first and then 250 remaining units of $ 100.

In this way, the final inventory balance is $ 10,000 (100 units at $ 100), an amount significantly less than that resulting from applying the FIFO method (see example).

| Bibliography: |

|---|

|

Leave a Reply